About Ray's Silver

.jpg/:/cr=t:5.56%25,l:0%25,w:100%25,h:88.89%25/rs=w:600,h:300,cg:true)

Stacking Silver

I'm an avid silver and gold collector and amateur coin seller/buyer, I own a flower shop (yes, you heard right, a flower shop) and silver and gold has grown from a side gig to a 2nd business. I have been buying silver coins, rounds, and bars for several years now as a hedge against inflation and part of my retirement plan. But with silver and gold prices increasing and the high premiums being charged on silver these days the only way to buy silver rounds or bars is to buy in large amounts. In most cases 500 ounces or more. And of course, being an individual investor/collector, I really don't need 500 ounces of silver at a time so I'll keep a 100 or so ounces and sell the rest to like-minded investors/collectors like you at a price slightly more then I paid but better then you can find online. Unless you want to buy 500 ounces at a time also.

I'm currently selling silver coins, rounds and bars at (Silver spot (Ask) price plus a small premium). I have a "ticker Bar" below showing silver and other precious metal spot prices. So, to find my current price for any of my coins, rounds or bars use the silver spot price and add the (plus) amount I have listed on the item, and you will get the current price. For example, if silver spot is $28.00 and my (plus) for an item is $2.00 you come up with $30.00. That would be the current price for that item.

If you have any questions on prices of the items listed below or wish to purchase silver that I have listed on this page, please contact me at 432-553-3123.

I accept cash, or payments made with CashApp, Venmo, Paypal, Zelle, and credit cards. There is a 3% fee added when using credit cards.

I also buy silver and gold coins and bullion so if you have any silver or gold rounds, bars or coins you want to sell let me know. I pay based on what the large Wholesalers are paying for 2nd Market Silver and Gold and will always give you the best price I can.

Also, if you have some rare or unusual gold or silver coins, I know a local Dealer that has always dealt fair with me, and I will gladly get you in touch with him.

Silver Prices

Silver Spot prices and Premiums

Spot price is the current per ounce price of silver on the open market

Premiums are the amounts above spot that dealers and brokers charge you when you buy silver from them. When buying silver make sure you know what the spot price is. That way you can deduct the spot price from the price of the item you are interested in and see what the premium is that you are being charged. For generic rounds you should expect to pay about $2.00 above spot. So, if your premium is much higher than that, keep looking around for a better deal.

New Items

Shipping Prices

Small Shipping Envelopes

If your ordering just a few items with total value of less then $500

Small Flat Rate Box

Orders of 20 to 100 ounces. Insurance will be added to shipping cost for orders over $500 in value

Medium Flat Rate Box

For orders over 100 ounces. Insurance will be added to shipping cost for orders over $500 in value

Average Insurance Cost

I cover the first $500 in insurance cost. For additional insurance over $500 I split the price of every $100 with you.

Additional insurance

For every $100 in value over the first $500 an additional $0.85 will be added to shipping cost.

Silver News

Gold Surges to Record High Amid Fed Rate Cut and Middle East Tensions

By Gary Wagner

Published:Sep 20, 2024 - 5:50 PMUpdated:Sep 20, 2024 - 5:57 PM

Kitco CommentariesOpinions, Ideas and Markets Talk

Featuring views and opinions written by market professionals, not staff journalists.

In a remarkable display of market dynamics, gold prices have soared to unprecedented levels, setting a new record high and closing price. This surge is attributed to a perfect storm of economic and geopolitical factors, primarily driven by the Federal Reserve's recent monetary policy shift and escalating tensions in the Middle East.

The Federal Reserve's decision to embark on its first interest rate cut since 2020 has sent ripples through the financial markets. In a bold move, the central bank slashed rates by 50 basis points, bringing the Fed funds rate to a range of 4.75% to 5%. This aggressive cut marks the beginning of what the Fed calls "interest rate normalization," with the ultimate goal of achieving a benchmark rate between 3% and 3.5% by 2025.

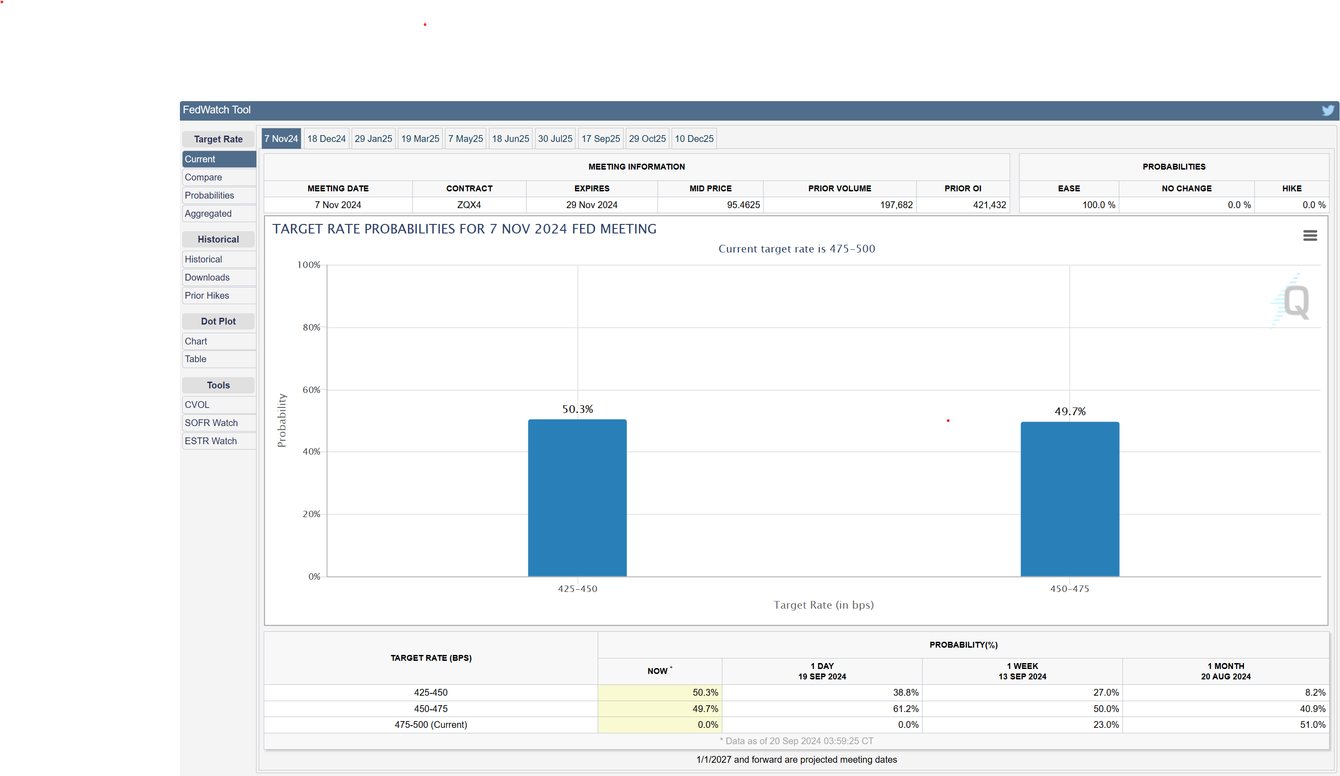

Market participants are closely monitoring the Fed's trajectory, with the CME's FedWatch tool providing insights into future rate expectations. For the November Open Market Committee meeting, there's a near-even split in probability between another 50-basis point cut (50.3%) and a more modest 25-basis point reduction (49.7%). Looking ahead to December, the tool suggests a 26.3% chance of rates settling between 4.25% and 4.5%, a 50% likelihood of rates dropping to 4% - 4.25%, and a 23.7% probability of rates falling as low as 3.75% - 4%.

Providing additional lift to gold's ascent are the heightening geopolitical tensions in the Middle East. The White House has expressed deep concern over the situation, particularly regarding the escalating conflict between Israel and Hezbollah. White House spokesperson Karine Jean-Pierre articulated this apprehension, stating, "We are concerned about the tension, and afraid, and concerned about potential escalation.”

The confluence of these economic and geopolitical factors has propelled gold to new heights. In just two weeks, gold futures have gained an impressive $120, with over half of that increase occurring in the last two days alone. As of 5:15 EDT, the most active contract month, December gold, was trading at $2,647.10, representing a substantial daily gain of $40.90.

This remarkable surge underscores gold's role as a safe-haven asset during times of economic uncertainty and geopolitical strife. The precious metal's performance reflects investors' growing appetite for stability amidst a landscape of changing monetary policy and international tensions.

As the Federal Reserve continues its rate normalization process and global events unfold, market observers will be keenly watching gold's trajectory. The interplay between monetary policy, geopolitical developments, and investor sentiment promises to keep the gold market dynamic and potentially volatile in the coming months.

For those who wish to learn more about our service, please go to the links below:

Information, Track Record, Trading system, Testimonials, Free trial

Wishing you as always good trading,

Frequently Asked Questions

Please reach us at rlboss1963@gmail.com if you cannot find an answer to your question.

Yes, if you are local just call, text or email me and let me know when you want to meet. We can meet at my shop "Flowerama" and I will gladly show you any of the items you have an interest in.

If you require shipping then again just call me, text me or email me and let me know what you want. I will send you a text or email in return with the total and instructions for payment by cashapp or venmo.

When I ship your selections, I will send you a photo of your requested items, another picture of the boxed items with mailing address showing and then a photo of the tracking number receipt. I include an invoice of you r purchase in the box with your items.

Well as I said before I have been buying silver for myself for a few years now and finally figured out the best way to buy silver (for me anyway) is to buy 500 1oz rounds at a time or 50 10oz bars at a time to get a good price. But I don't always want to keep that many of that one type so I will keep what I want and sell off the rest. Normally I can give you a better price for small amounts than you would get buying off the web so we both get a good deal.

Subscribe for Special Offers

Sign up to hear from me about specials, sales, and events.

Contact Us

Better yet, message or call!

Please keep in mind that I operate as an individual out of my work place and home. I may not be able to answer you right away.

I'll get back to you as soon as I can!

Ray's Silver

907 Andrews Highway, Midland, Texas 79701, United States

Ray Boss - 432-553-3123 rlboss1963@gmail.com

I work out of my main business (Flowerama of Midland) and from home so please message, text or call

Today | By Appointment |

I do not have a store front. I do this as an individual so call, text, or message me to set up a time to talk or meet.

Copyright © 2024 Ray's Silver Coins, Rounds & Bars - All Rights Reserved.

Powered by GoDaddy